King Hussein Business Park is Amman’s premier destination for innovation, investment, and impact. As a multi-asset development, KHBP offers future-ready infrastructure, modern office spaces, and a vibrant ecosystem for growth.

Key Features

- • 151,000+ sqm of developed space

• Phase Two: 266,000 sqm; Phase Three: 196,000 sqm

• Modern offices, co-working spaces, and commercial outlets

• Strategically located in a government-supported Business Development Zone

• Exclusive tax incentives and business-friendly regulations

Driving Economic Growth

KHBP is home to:

- • 300+ local startups

• 30+ international companies

• 24 regional corporations

• 10,000+ jobs created for Jordanians

We focus on high-impact sectors including ICT, healthcare, media, education, hospitality, and retail, creating a thriving hub for businesses, industries, and people.

Why Choose KHBP

- • Flexible, modern spaces built to global standards

• A collaborative ecosystem driving innovation and growth

• Ideal for local and global expansion

• Strong public-private partnerships and investment opportunities

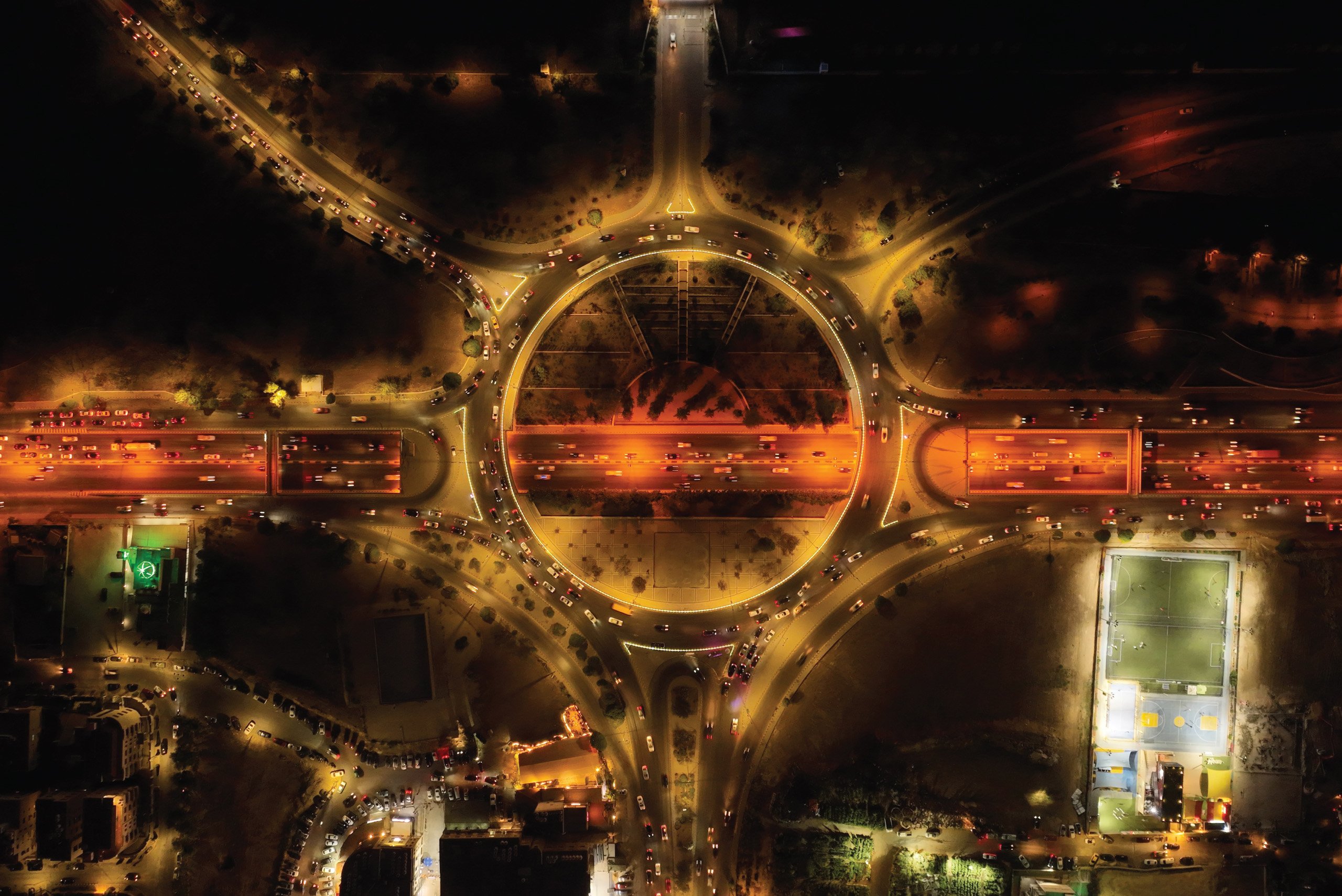

Strategic Location

KHBP is located in the heart of Amman within a designated Business Development Zone, offering exceptional advantages for businesses looking to scale and lead. Backed by government support, exclusive tax incentives, and advanced infrastructure, KHBP provides the ideal foundation for sustainable growth.

Jordan’s geographic and digital position adds even more value. As the Digital Hub of the Middle East, it plays a central role in the region’s rapidly growing digital economy. Its strategic location makes it a vital gateway for regional trade and cross-border economic revitalization.

KHBP builds on this national momentum by connecting global businesses with opportunity through a strong, future-focused platform.

Partnering for the Future

KHBP partners with local and international investors to expand its offerings across business, leisure, and lifestyle, cementing its position as a leading destination for sustainable urban growth.

King Hussein Business Park is Amman’s premier destination for innovation, investment, and impact. As a multi-asset class development, KHBP offers future-ready infrastructure, state-of-the-art office spaces, and a vibrant business ecosystem designed to accelerate growth.

Key Features

- Over 151,000 sqm of developed space

- Phase Two expansion of 266,000 sqm and 196,000 sqm in Phase Three

- Modern office spaces, co-working environments, and commercial outlets

- Strategic location within a government-supported Business Development Zone

- Exclusive tax incentives and business-friendly regulations

Driving Economic Growth

KHBP is home to:

- 300+ local startups

- 30+ international companies

- 24 regional corporations

- Over 10,000 jobs created for Jordanians

We focus on high-impact sectors including ICT, healthcare, media, education, hospitality, and retail, creating a thriving hub where businesses, industries, and people connect.

Why Choose KHBP

- Flexible, future-ready spaces built to international standards

- A collaborative ecosystem designed to fuel innovation and growth

- Ideal conditions for local and global expansion

- Strong public-private partnerships and access to investment opportunities

Strategic Location

KHBP is located in the heart of Amman within a designated Business Development Zone, offering exceptional advantages for businesses looking to scale and lead. Backed by government support, exclusive tax incentives, and advanced infrastructure, KHBP provides the ideal foundation for sustainable growth.

Jordan’s geographic and digital position adds even more value. As the Digital Hub of the Middle East, it plays a central role in the region’s rapidly growing digital economy. Its strategic location makes it a vital gateway for regional trade and cross-border economic revitalization.

KHBP builds on this national momentum by connecting global businesses with opportunity through a strong, future-focused platform.

Partnering for the Future

KHBP partners with local and international investors to expand its offerings across business, leisure, and lifestyle, cementing its position as a leading destination for sustainable urban growth.

Services That Elevate Your Experience

From seamless daily operations to exceptional tenant services, KHBP is committed to creating a comfortable, connected, and high-performance environment for every business and individual.

Services That Elevate Your Experience

From seamless daily operations to exceptional tenant services, KHBP is committed to creating a comfortable, connected, and high-performance environment for every business and individual.

Services That Elevate Your Experience

From seamless daily operations to exceptional tenant services, KHBP is committed to creating a comfortable, connected, and high-performance environment for every business and individual.